The second most valuable cryptocurrency, Ethereum, has already announced a step to significantly reduce energy consumption and plans to implement it as soon as this year.

Switzerland, Finland, Sweden, Slovakia, Argentina. Do you know what these countries have in common? Mining and running the Bitcoin infrastructure consumes more energy annually than the population of these countries. Today, Bitcoin still represents a relatively small but growing ecological threat, with its "mining" responsible for approximately 0.5% of all energy consumption in the world. You can check the exact numbers and the development over time on the website of the University of Cambridge.

Greenpeace vs. Bitcoin

Greenpeace and several allied environmental organizations recently launched a campaign to "clean up" Bitcoin. Based on the impulse of American local initiatives, Greenpeace demands a reduction in its energy intensity and the resulting ecological burden from the world's most valuable cryptocurrency. The campaign is called: "Change the Code Not the Climate".

Greenpeace's initiative was prompted by local communities reopening coal power plants in search of cheaper energy for Bitcoin mining (transaction verification). According to the director of the campaign and former head of the environmental organization Sierra Club, Michael Bruno, today comes the revitalization of old gas-fired power plants that were economically unsustainable.

We know who can make it happen because we know who wields influence over the crypto community.

— Change The Code (@CleanUpBitcoin) March 29, 2022

Leaders like @elonmusk, @jack, and Abby Johnson of @Fidelity have vested interests in #Bitcoin — and we're calling on them to use their power to stop Bitcoin from wasting ours. pic.twitter.com/Q6G19mIhsd

Michael Brune told the Guardian: “To see this development within the US energy sector is extremely painful. It was during the closing of these power plants that we made important progress during the last 10 years. If we revive fossil power plants like this, we will never fulfill our ecological obligations."

In connection with Bitcoin, environmental organizations also draw attention to the significant use of fossil fuel power plants for coal and oil. According to the New York Times, Bitcoin consumes 7 times more energy than all of Google's operations. The solution to the environmental burden proposed by Greenpeace is surprisingly simple. A simple code change is said to be enough to reduce energy consumption by more than 99%.

Code change

All transactions in cryptocurrencies must be verified, just like monetary transactions in national currencies. Verification, which in the traditional financial system of classic currencies is the responsibility of central financial institutions (banks, governments) in the case of cryptocurrencies, is performed by the so-called validators.

According to investopedia.com, there were as many as 18,000 different cryptocurrencies in the world in March 2022. If we exclude straightforward fraudulent currencies, the verification of transactions within the blockchains of all cryptocurrencies is basically based on only one of two basic principles: Proof of Work or Proof of Stake. But what is the difference between these systems and why are environmentalists pushing to change the code from one to the other?

Proof of Work – turning energy into security

Since the beginning of its existence as a pioneer of cryptocurrency technology, Bitcoin has been verifying transactions based on the principle of decentralized control using the Proof of Work system.

Bitcoins themselves, the total number of which is limited in the future, are created today as a reward for the verification (validation) of transactions in the so-called blockchains. However, the validation of transactions, and thus the "mining" of new bitcoins based on Proof of Work, is increasingly technically demanding.

If Bitcoin "miners" want to gain the privilege of confirming a transaction under Proof of Work, they need a lot of electricity, as their infrastructure has to solve extremely complicated cryptographic puzzles as quickly as possible to confirm a transaction. All over the world, a number of technologically and energy-intensive calculations are simultaneously and constantly taking place.

The privilege of confirming the transaction goes to those miners who have the largest computing capacity and perform the calculations the fastest. It is precisely with the increase in the performance of competing miners that the claim to the speed of calculation (and the resulting privilege of validating a transaction associated with a reward in bitcoins) is constantly increasing.

While in 2009, according to the New York Times, you could "mine" one bitcoin in a few seconds with one ordinary desktop computer, today you need the power corresponding to the 9-year electrical budget of an average American household and a specific ASIC infrastructure worth tens of thousands of dollars.

Verification of the transaction in the Proof of Work method is intended to guarantee that the transaction will be recorded only through trusted "miners" who do not lie or rob in the interests of the people carrying out the transactions. According to the New York Times, the logic of the Proof of Work system calculates that, from an economic point of view, it makes more economic sense for a potential fraudster or hacker to invest in mining and thus obtain the possibility of a reward in bitcoins.

Precisely because of the enormous complexity of bitcoin mining today, the process is left almost exclusively to companies or groups of investors who rely on huge data centres. According to btc.com, up to 80% of all computing power for verifying transactions is now concentrated in the hands of 7 "mining companies", primarily in the USA or China.

Proof of Stake - verification through guarantee

Greenpeace considers the verification system through the solution of complex mathematical problems to be an unnecessary waste and proposes a historically newer, but significantly more gentle way to guarantee the trustworthy and safe operation of cryptocurrency - Proof of Stake.

The guarantee for the correct execution of the transaction in the Proof of Stake system does not take place on the basis of competition in the performance of computing systems, but by simply guaranteeing one's own property in cryptocurrency. There are several possible mechanisms for selecting "validators". In addition to the number of coins, the time spent on the "waiting list" or simple chance plays a role.

In practice, however, the probability that the protocol will select you to verify the transaction and you will thus be entitled to a reward for mediating depends on the value you vouch for. This year, exactly 32 ethereum will be needed to verify a transaction in the ethereum blockchain. If you do not own that many, it is worth combining the strength of your portfolio with other guarantors in the so-called "pool".

According to Adam Kracík, who has been working as an independent editor in the world of cryptocurrencies for five years, the existence of "pools" makes the Proof of Stake method significantly more democratic than Proof of Work. "You don't need exactly 32 ethers to become a "validator". It is enough if 32 people gather with one ethereum.”

If the applicant for transaction verification plans to cheat and verify a non-existent transaction, or to enrich himself illegally, any of the other members of the network can initiate an assessment of the transaction (fact-checking). If, on the basis of it, the malicious intent is revealed to be true, the validator will lose part or even the entire amount of ethereum that he used as a guarantee, as a punishment.

From an ecological point of view, which is also emphasized by Greenpeace, it is crucial that when verifying transactions and recording them in blockchains through Proof of Stake, energy-consuming powerful computing systems are not needed. Transaction verifiers need stable Internet access, an average computer and basic capital in the cryptocurrency in question. Mining a cryptocurrency operating on the Proof of Stake principle appears to be a more attractive, more ecological and, last but not least, the cheaper alternative.

However, it is a less proven technology that the first cryptocurrencies started using in 2012. The company Peercoin became a pioneer and today it is used by, for example, Caldoran, Tezos or Algorand.

Vitalik Buterin, the founder of the second most valuable cryptocurrency ethereum, announces a full transition to Proof of Stake technology as soon as this year. The transition should save up to 99.95% of energy worldwide compared to the current verification via Proof of Work.

According to Adam Kracík, there is a consensus in the Ethereum community that Proof of Stake is the right way to go. However, if part of it still decides to stick with the old code, ethereum can split (“fork”) into two cryptocurrencies, similar to what happened with bitcoin when bitcoin cash was created in 2017.

Blockchain trilemma

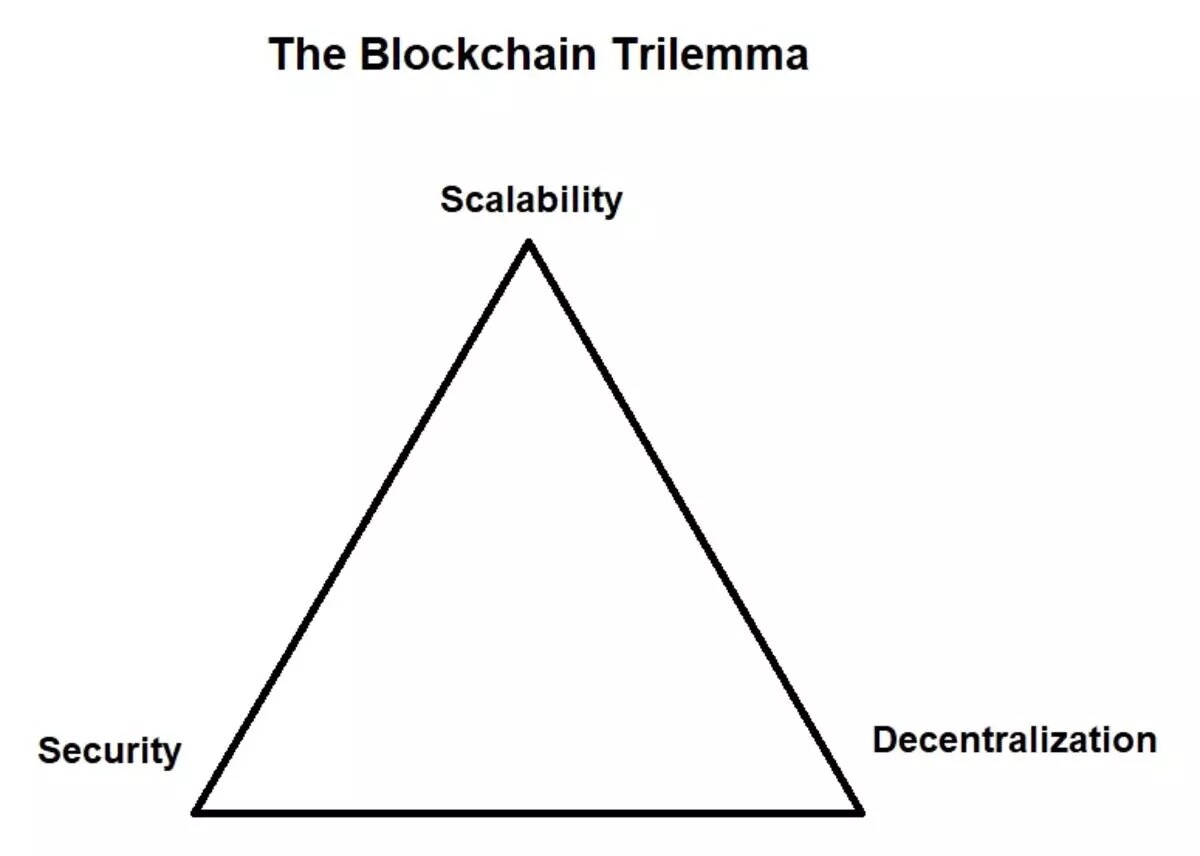

Each cryptocurrency faces the so-called “blockchain trilemma”. To understand it, Adam Kracík advises us to imagine a triangle that has speed, security and decentralization at its peaks. “The problem is that no cryptocurrency has yet managed to achieve a simultaneously fast, secure and decentralized system. In practice, the blockchain always leans towards a maximum of two vertices. As a result, we can have, for example, a fast and secure blockchain, but it will not be decentralised."

According to Adam Kracík, the Bitcoin community considers maximum decentralization and security to be the highest priorities, for which it is willing to sacrifice the speed of transactions. According to him, the principle on which they design Proof of Stake in ethereum has never worked for a long time. "Cryptocurrencies that work on Proof of Stake today have a low number of validators, and their network is fast and secure, but not very decentralized. Ethereum will be the first cryptocurrency that can confirm whether trust in Proof of Stake really pays off.”

Will Bitcoin also go green?

Ethereum's transition from Proof of Work to Proof of Stake began, according to Adam Kracík, when the cryptocurrency launched a "pilot version" of a new multichain called "beacon chain" in December 2020. "The transition will take place in a way that the old confirmation will be required for one block, and proof of the correctness of the transaction from the beacon chain will be required for the new one. The only thing that changes in principle is the proof that the blockchain is correct and all validators agree on its state. The transition is expected to be seamless."

However, according to Adam Kracík, it will not be easy at all to convince developers and miners of Bitcoin about the potential of Proof of Stake. The most important players in the field of mining have already invested huge amounts of money in computing technology, so they definitely do not want to lose their established position.

According to him, the Bitcoin community is typically conservative, and given Bitcoin's longevity, he also considers the method of verifying blockchains using computational operations to be historically reliable. "They are used to being in conflict with the state and society. However, I do not rule out that if Ethereum's transition to Proof of Stake succeeds, a dispute between two currents of opinion may arise in the future with Bitcoin as well."

According to Adam Kracík, appealing to several leading representatives of the community, such as Elon Musk or Jack Dorsey, as Greenpeace does, is not very important. "The possible transition will in any case be decided by the core developers who create and rewrite the codes to which they are the only ones with access. However, changing the bitcoin code will only be the first step, since the change has to also be accepted by the system operators, the so-called miners."

Zobraziť tento príspevok na Instagrame

In addition to environmentalists, governments are also pushing to limit the energy consumption of bitcoin developers. Bitcoin mining has already been significantly limited by China and Kazakhstan..

According to Adam Kracík, states with legislation limiting cryptocurrencies should wait until it is clear which technology will prevail in the long term. “The debate about changing the Bitcoin code has somewhat outpaced technological developments. Bitcoin has not yet communicated any plans in this direction, and if they did, the transition would take them four or five years. Public access to cryptocurrencies should be patient and forgiving for a while while testing different approaches.”