Latex model Natália: It turns me on to be a live f*ck doll. I can turn into a completely different person

Latex model Natália: It turns me on to be a live f*ck doll. I can turn into a completely different person

Latex model Natália: It turns me on to be a live f*ck doll. I can turn into a completely different person

Latex model Natália: It turns me on to be a live f*ck doll. I can turn into a completely different person

Turning 500 Dollars into Almost 5 Million. Young Adam Made a Fortune on the Polarizing OHM Cryptocurrency.

The OlympusDAO project resonates a lot in the world of cryptocurrencies today, aspiring to become the world's future reserve currency instead of the dollar. Could it be real? Isn't it just a sophisticated pyramid scheme?

If problems persis, please contact administrator.

The American dollar isn't backed up by anything apart from an endless US debt, so it could inevitably burn in flames tomorrow, in a year or in ten years. The world will have to find a new reserve currency for all business venture use. Could it be OHM?

Recently, there's been a lot of buzz around this one project - OlympusDAO, which boasts an annual interest rate of more than 8,500 percent. Could it be that someone invented a way to make people money endlessly and without risk?

It's not that simple, but there is no doubt that this protocol has turned many people into millionaires to this day.

- What is the main idea of the OlympusDAO project.

- How is it possible that the protocol promises 8,000 percent interest on your investment.

- What is staking, and how does bond issuance and treasury protocol work.

- How a 30-year-old Czech dude managed to earn 5 million dollars.

- What does it mean that the protocol owns 99 percent of its liquidity.

- What are the risks of investing your money?

What is OlympusDAO?

The Olympus project describes itself as a "decentralized reserve currency" that aims to create a stable community-owned cryptocurrency with the idea of keeping its purchasing power at the same level, while the dollar's purchasing power is declining every year due to inflation.

In practice, this means that for one dollar today you can afford less than last year and significantly less than a hundred years ago. OlympusDAO wants to reverse this trend with its structure, so the OHM coin was designed to retain its purchasing power forever.

The protocol guarantees that 1 OHM will always have a value of at least 1 dollar, but allows the market to arbitrarily decide whether to value 1 OHM higher than that. Various coins in the protocol treasury serve as a guarantee of value. According to the creators, 1 OHM does not depend on the state debt or the army, but has assets that guarantee a minimum value.

Has the OlympusDAO project found a recipe for creating a financial infrastructure of the future, or is it just aimed at attracting as many new investors as possible to invest their money into it?

Stable coin or decentralized reserve currency

The cryptocurrency world has long understood that it needs at least some degree of stability to trade and invest in individual coins at the most appropriate time. Imagine making thousands of dollars as a result of the increase in cryptocurrencies you have invested in, but now you want to keep them in a currency that does not fluctuate significantly during the day. You do not want to collect the profit from the bank, but also you definitely don't want to leave it invested in a high risk situation.

In the world of cryptocurrencies, you can exchange your profit for a stable currency that's pegged to the value of the dollar or the euro. The principle of operation of stable coins is simple. Ideally, the central authority that issues crypto dollars should have the same value of real dollars as the digital ones. However, the reality often differs.

Many stable currencies today do not cover their digital coins with the same value in dollars or euros. Some coins are only partially covered by real money, others aren't covered at all, but the biggest stir with this approach was caused by OlympusDAO.

The creators of the OlympusDAO protocol argue that relying on the digital dollar in times of market fluctuations is contrary to the basic idea of cryptocurrencies. Cryptocurrencies were created to allow people to break away from the mainstream financial system. Today the vast majority of people trade in the digitized dollar they rely on instead of real cryptocurrencies.

An interest of more than 8,000 percent that will make you millions?

It's not an easy task to explain the philosophy and operation of the OlympusDAO protocol to someone who is not a cryptocurrency expert. Olympus is unlike other stable currencies because it did not tie its price to the value of the dollar. Instead, it bases the value of its coins on the assets (cryptocurrencies) in its treasury. With these assets, the protocol guarantees that the value of 1 OHM will never fall below 1 DAI.

One OlympusDAO coin (abbreviated OHM) has a specified minimum value of 1 DAI, which translates to 1 dollar, but the protocol does not specify a maximum value. Although OHM is currently trading for more than 1,000 dollars, it is not really a price determined by the authors of the protocol in any way. The free market is responsible for the current value.

Why would anyone be willing to pay more than a thousand dollars for a coin whose real value based on the assets deposited in the treasury of the protocol will always be 1 dollar?

OlympusDAO attracts new investors especially with the extremely high interest rate, thanks to which you can increase your amount of OHM coins. The current annual interest rate is over 8,000 percent and the partial interest is paid three times a day, so as a result, the number of your coins will grow beautifully.

When the protocol inspires new projects

Several new projects have been created on the same principle as OlympusDAO, which operates on the ethereum network. The most famous today are projects such as Klima, Time or Temple. Klima seeks to apply the same principle of operation as OlympusDAO to an environmental initiative, thanks to which investors, together with the protocol, are trying to reduce air pollution and drive companies to switch to cleaner energy.

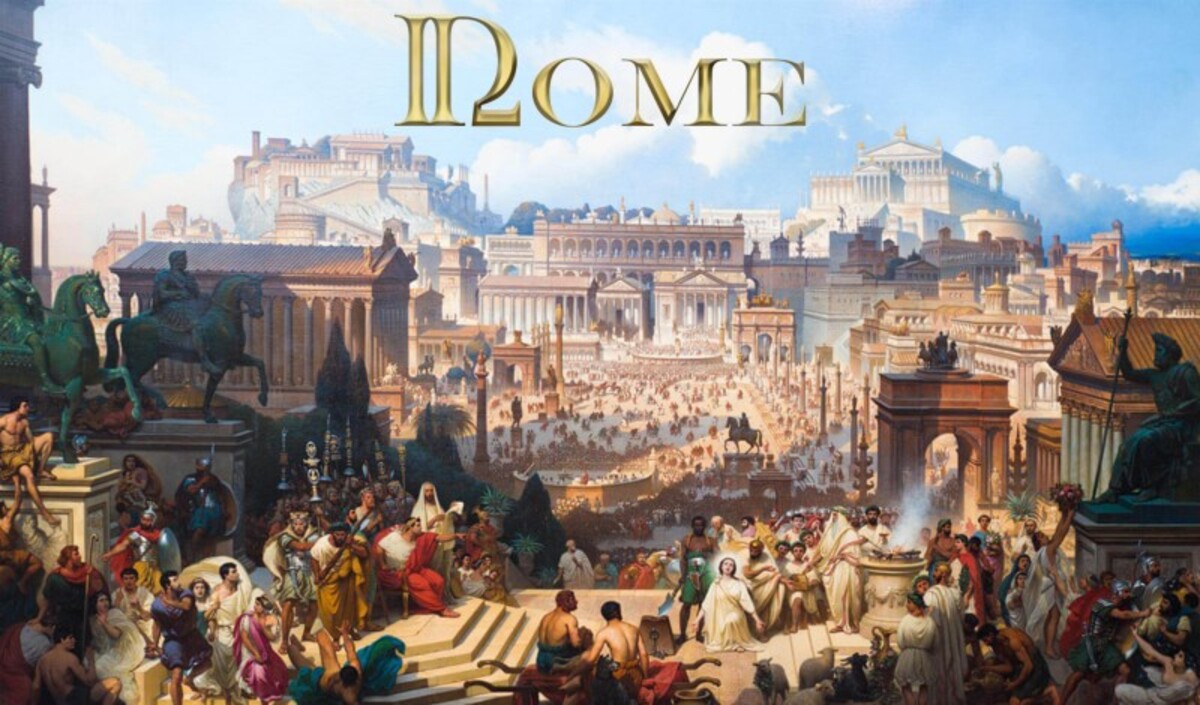

One of the popular projects is RomeDAO, which aspires to become a decentralized reserve currency in the Kusama and Polkadot ecosystems, while using the original functionality of the OlympusDAO protocol enhanced by new bond or interest rate mechanisms.

this is what @Wonderland_fi was supposed to do. remains unclear if they will, but props to @romedaofinance for picking up the torch. I hope to see more follow suit.

— Zeus Ω (3, 3) (@ohmzeus) October 27, 2021

RomeDAO has also bet on an ancient theme, it's building a community on socials and is planning to experiment with accumulating assets in the treasury in a more innovative way than Olympus. Prior to the expected launch in mid-November, the creators are fine-tuning the last details to learn from the shortcomings of the Olympus protocol so far and to create a more stable growing project.

According to the founders of the project, RomeDAO is backed by several employees who once stood at the birth of OlympusDAO, but there is no official partnership or alliance between the two projects. A few days ago, the creator of the Olympus protocol, also known as Zeus, highlighted RomeDAO on Twitter as a project that seeks to build on OlympusDAO's original idea of trying to improve the protocol and not just take advantage of its popularity.

As a 24-year-old, Peter made 500,000 dollars on these projects

The popularity of projects operating on the principle of liquidity ownership together with the bond offering at a discounted price has also risen recently. We got in touch with 24-year-old Peter, who's recently managed to earn some fabulous money on the OlympusDAO and Klima projects. For security reasons, we don't disclose his full name.

"I actually caught OlympusDAO right at the beginning. Then I just watched the development, joined the Discord and read on. Unfortunately, I turned off the notifications, and when the addresses were collected for the presale, I did not participate. When Klima was mentioned on the OlympusDAO Discord, I immediately joined and took an active part in the test. Thanks to that, fortunately, I got into the presale," Peter explains how he came across the two projects.

He doesn't think that these projects are sophisticated frauds or pyramid schemes. To such criticism he responds by saying that we must always think one step ahead in the world of cryptocurrencies.

Jump on and jump off just right "It's important to distinguish between a Ponzi scheme and a Ponzi game. The scheme is usually designed to rob people who join late. Ponzi's game is all around us. You gotta jump on and jump off just right. And this applies to almost any investment. Of course, it's necessary to be careful about projects that try to benefit from the popularity of OHM," he explains his tactics on how not to be deceived in the unstable world of cryptocurrencies.

Despite joining OlympusDAO later, he has managed to raise 74,000 dollars so far from an initial investment of 10,000. He did way better in the case of the Klima project, where he invested 3,000 dollars, and is currently at 155,000 dollars, already earned and sold 436,000 dollars.

He has turned 500 dollars to 5 million30-year-old Adam, from the Czech Republic, is much better off. He has been involved in the OlympusDAO project from the very beginning. "I got into OHM at the beginning of the year thanks to Fiskantes' tweet, I joined the Discord and I was instantly absorbed in the vibes of this community. There were only a few hundred people there. Given that, Discord servers of this size can be easily monitored during work," he reminisces to March this year.

From his previous experience, he doesn't feel that it's a typical pyramid scheme, because the project is based on transparency, according to him.

"You know exactly what happens to the funds. You'd never know that in a Ponzi scheme. The FAQ also discusses the bankruptcy scenario in case everyone decides to sell their coins at once. For the last remaining people in staking, this is quite good thanks to the rapidly rising interest rate at a time when there's a smaller percentage of coins stored in the protocol. In a Ponzi scheme, the last people don't get anything whatsoever," Adam thinks.

The initial investment was not very high in his case, but thanks to the growth in the value of OHM, he is now part of one of the majority components of the portfolio. "In the pre-sale, I was able to invest 568 dollars in OHM and 1,000 dollars in Klima. As of October 30th, the current value of OHM is approximately 4.75 million dollars. As for Klima, the project was launched only a few days ago and the value today is already 330,000 dollars," concludes the young crypto enthusiast.

Revolutionary idea of how not to lose liquidity

Many new projects in the world of cryptocurrencies suffer from a fundamental liquidity problem. Imagine starting a new project, creating 1 million coins, and you need to make sure people can buy your coins in exchange for ether. To get started, you need liquidity so that people coming with their ethereums on the decentralized exchange get a lot of your coins for it according to the current price.

The lower the liquidity, the greater the price jumps with each purchase and sale. New projects therefore offer people rewards for securing liquidity. Instead of buying only the coin for 5 ETH, you divide this amount in half. For 2.5 ETH you buy a coin and you keep 2.5 ETH.

You then mediate the liquidity by depositing both the coin and the ETH in a 1: 1 ratio to the decentralized exchange and, thanks to the initial rewards, collect a percentage of fees for each trade executed in this liquidity pair. However, high initial remuneration for liquidity intermediation does not persist forever, and therefore capital is rapidly shifting.

Sale of discounted bonds in exchange for liquidity

It often happens that the liquidity of a new project gets mediated by a large number of people, but the less fees they collect, the more intensely they seek alternatives and flee where the shares are higher. OlympusDAO has therefore thought of a way to prevent liquidity leaks. You can easily buy OHM coins on a decentralized exchange, or buy coins for 1,000 dollars, add 1,000 dollars in the DAI currency and create a liquid pair.

Because OlympusDAO does not want you to own the liquidity and be able to leave with it at any time, the protocol offers the so-called bonds, translated as bonds that motivate people to pass the liquidity.

How so? Well, the motivation is quite simple. The protocol offers a discount on the purchase of your coins in exchange for liquidity, so when 1 OHM is sold on the market for 1,050 dollars, you buy it in exchange for liquidity, for example, for 1,000 dollars. Subsequently, the protocol has its liquidity under control, while you're receiving the newly created OHM coins in exchange.

The protocol is governed by the rule that it must have at least 1 DAI (1 dollar) in treasury for each new OHM coin created, so 1,049 dollars of 1,050 is a profit for OlympusDAO. From this profit, it subsequently increases the treasury, but the money is mainly used to reward people who are engaged in staking.

Develop the assets by staking

If you could constantly generate liquidity, sell it back to the protocol and receive discounted coins without any restriction, you would would be able to regularly increase your investment by a few percent on a regular basis. In this case, however, the protocol will not allow you to sell the coins obtained by buying alias bonds for the first five days and then motivates you to not sell the coins at all.

OlympusDAO offers the option of staking to its investors, which basically means holding the coins in a protocol while your coins generate new coins. It is at this point that extreme interest of more than 8,000 percent comes into play. Thanks to that, it's not worth buying and selling coins with a profit of a few percent, when you can leave them in the log, use staking and let the number of your coins grow.

In practice, this works in a way that even though the minimum value of 1 OHM coin will be a mere 1 dollar, people are willing to pay more than a thousand dollars for the same coin in order to get a share of the imaginary pie of the total market capitalization protocol.

They believe that in the future it will pay to hold a certain amount of OHM coins, as the OlympusDAO protocol will continue to be successful, and even if the value declines rapidly, the ability to generate insanely high interest will pay off and the decline will compensate for the amount of coins generated by staking.

What are the risks of OlympusDAO?

On paper, the principle of the OlympusDAO protocol really sounds like a revolutionary idea in the world of cryptocurrencies, which can increase your assets. As with any cryptocurrency, caution is necessary.

First of all, it's an experiment that can fail based on the mood of the market, or human error. Currently, OlympusDAO strives to fully develop and entice as many people as possible to buy their coins, whether on decentralized exchanges or via bonds.

On the stock exchange, it earns from trading fees because it owns more than 99 percent of its liquidity. It also has tremendous earnings from bonds, because it takes 1 DAI (1 dollar) to create a new coin. In the meantime, people are easily willing to buy 1 OHM for a thousand dollars.

Once the start-up phase is over, the number of new investors will fall, the volume of daily transactions will decrease. The protocol's treasury revenues will fall, and interest rates will necessarily have to fall as well. Forget about the crazy interest rate of more than 8,000 percent, it remains a matter of time before we this new phase is introduced. The creators themselves say that after the first phase of rapid development, the stabilization phase will come into effect, and the interest and the value of one coin will probably fall.

Is it a pyramid scheme?The community of more than 30,000 people on Discord is trying to delay this phase, calling themselves the Ohmies, motivating new investors every day to put their money into OlympusDAO. The more new money flows into the treasury, the better the interest can be for anyone who has honestly deposited their OHM coins in the log and generate new ones by staking.

This factor therefore often attracts criticism that OlympusDAO is just a sophisticated pyramid scheme that requires new people with the money to make the most of the system.

What's also concerning is that the treasury, which now contains assets worth more than 600 million dollars, is being managed by the creators of the protocol. For any movements and transactions, the treasury requires the consent of at least 4 out of 7 creators, which OlympusDAO considers a strong collateral, but if four of them took more than half a billion dollars, no one would have been too surprised.

The favorite meme of OlympusDAO fans is 3.3. It's a reference to a strategy from game theory, according to which it is best for people and for the protocol when the investors buy their OHM coins and leave them in the protocol for staking. If someone starts selling, it will only worsen the situation for the protocol and other investors.

However, recording profits is a natural part of investing. In mid-October, the value of 1 OHM jumped above 1,300 dollars, which caused a massive sell-off of coins and a subsequent drop in prices to 700 dollars, from which it gradually bounced up again. However, the rigidity and popularity are still huge, so there's no shortage of new money inflows. But how long will it last?

If problems persis, please contact administrator.