She Likes Fascist Symbols And Stands Against Abortion, LGBT And Migrants. This Is The Italian Prime Minister Giorgia Meloni

She Likes Fascist Symbols And Stands Against Abortion, LGBT And Migrants. This Is The Italian Prime Minister Giorgia Meloni

She Likes Fascist Symbols And Stands Against Abortion, LGBT And Migrants. This Is The Italian Prime Minister Giorgia Meloni

She Likes Fascist Symbols And Stands Against Abortion, LGBT And Migrants. This Is The Italian Prime Minister Giorgia Meloni

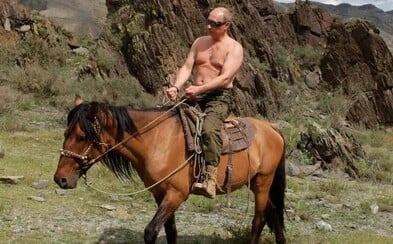

6 Facts About Russia's Economy: Does Putin Feel The Effect Of Sanctions Imposed By The West After The Russian Attack On Ukraine?

In their study, a group of economists from Yale University explains the impact of economic sanctions imposed on Russia by Western countries. What does their reach look like in numbers?

If problems persis, please contact administrator.

A group of economists from Yale University developed and published an extensive study that explains how the effects of economic sanctions affect the Russian economy. Although the Russian side often tries to obfuscate and downplay their effects, the experts in their study claim the opposite and describe the overall devastating effects of the sanctions on the Russian economy.

1. Who is more dependent on gas?

Probably the most discussed topic in the economic sanctions imposed on Russia is the limitation of Russian gas supplies and the instability that Moscow has recently caused by limiting its supplies. However, experts from Yale University explain that Russia is much more dependent on trade with Europe than Europe is on importing Russian gas. While Russia exports up to 83 percent of its gas to Europe, it represents about 46 percent of its consumption for Europe.

The report further explains that for Europe, the limitation of Russian gas supplies will be a short-term problem accompanied by higher prices and a change in the supply structure. In short, it will be a challenge for Europe's energy security and economy, but it will be manageable. However, it will not be a fundamental strategic problem for Russia, which will lose its most important customer. Even when trading with Russian gas, the question arises whether its alternative market can be China.

According to experts, it would cost Russia a lot of money to build pipelines to China, and it is unlikely that it would be able to set up similarly favourable contracts as it has with European customers, since China's strategy is to push prices down.

In their analysis, experts also emphasize that Russia has become an unreliable trading partner due to gas restrictions, which uses gas as a strategic weapon, and therefore countries will tend to limit the import of Russian gas.

2. Will China replace Europe?

Data from the report mainly point to Russia's dependence on China. The Chinese market is absolutely irreplaceable for Russian trade, and Russia imports the most goods from it. On the contrary, the largest consumer of Chinese exports is still the United States of America, with a huge lead, to which China exported goods worth more than 500 billion dollars in 2021. Russia, with received exports in the amount of 72 billion, becomes the eleventh largest market for the country.

Russia thus finds itself in the position of an unequal relationship with its trading partner, when it needs China much more than China needs Russia.

The fact that the next largest Russian importers in 2021 were Western countries, which are gradually limiting their exports to Russia, is also a problem. Germany was in second place last year, and the United States of America was in third place.

Many Russian economists emphasize the need to find new trade partners and expand the range of countries from which Russia could import products, but the reality is that there are few potential partners who would like to establish an economic relationship with Russia.

The situation is all the more complicated because most of those who are willing to do business with Russia, such as Belarus, do not belong to the most technologically advanced powers, and it will therefore be very difficult to find new suppliers, for example in some technological segments.

3. What impact will the departure of many foreign companies have on Russia's GDP?

Gradually, since the beginning of Putin's aggression in Ukraine, more than 1,000 foreign companies have left the Russian market, having invested a total of more than 600 billion dollars in the country and employing around one million inhabitants. Experts state in their report that this amount represents roughly 40 percent of Russia's GDP. A number of companies are currently liquidating their Russian operations, limiting their activities or selling them to local owners.

On average, for multinational corporations, leaving the Russian market accounted for 1 to 2 percent of their revenues.

Foreign companies not only represented considerable capital on the Russian market, but also brought business know-how and Western technologies. The published study even says that the exit from the Russian market for many companies did not represent significant economic losses, as was assumed. The exit from the market attracted a number of global investors, and thus partially offset the losses associated with the sale of Russian assets. On average, for multinational corporations, leaving the Russian market accounted for 1 to 2 percent of their revenues.

4. Which segment of the Russian economy fundamentally suffered?

Disruption of the supply chain caused by Western sanctions fundamentally affected the automotive industry in particular. A number of automakers have either limited or stopped sales in Russia. The market is struggling with rising car prices, insufficient supply and also missing parts in the market. Russian cars will be without airbags or ABS, and due to the lack of Western technology, they will fall decades behind.

The list of foreign car companies whose sales in Russia fell by more than 90 percent year-on-year in June 2022 is long and striking: Lexus, Volvo, Fiat, Porsche, Toyota, Land Rover, Skoda Auto, Volkswagen, Mitsubishi, Audi, Jaguar, Suzuki , Nissan, Lifan, Renault, Ford, Hyundai, Opel, Infiniti, Lada, Mazda, Kia, Peugeot, Citroën, Subaru, Jeep, Geely, UAZ. It means that consumption in the segment has fallen across different price categories as well as different countries of origin of the brands.

However, the study further adds that the automotive sector is not the only one where consumption has fallen to a minimum. Several high-tech industries, such as smartphones, also have problems. Most international smartphone makers are no longer shipping products to the country, and stocks have been depleted by panicking consumers in the initial frenzy following the start of Russia's invasion of Ukraine.

5. Is it easy for Russia to change oil buyers?

Russia is the world's third largest oil exporter, producing 11.3 million barrels per day, of which up to 88 percent is exported. Roughly 50 to 60 percent of Russian oil goes to Europe, and another 20 percent is destined for the Chinese market.

According to data from Yale University, in 2021 the profit from oil exports was three times greater than the profit from gas exports and represented up to 45 percent of the country's budget. Only 10 percent of production falls under independent or private producers, the rest of production is in charge of state-owned enterprises.

The profit from oil exports was three times larger than the profit from gas exports and represented up to 45 percent of Russia's budget.

After the agreement of the European Union, which decided to put an end to Russian oil, the question arose whether China or India could become an alternative buyer for Moscow. Although Russian oil exports to Asia have increased over the past year, experts say it is virtually impossible for China and India to be able to absorb production of 6 million barrels per day within a year. In addition, the mentioned countries buy Russian oil at a significant discount.

Another problematic change is the fact that Russia has to transport oil to the mentioned destinations by tankers, while the time for transporting oil to Europe takes dozens of days less than to South and Southeast Asia. By comparison, it takes two days for oil to go via pipeline to Eastern Europe, but it takes 35 days to travel to East Asia.

In addition to credibility within OPEC (Organization of Petroleum Exporting Countries), Russia also loses a significant part of revenues to the state treasury and will be dependent on the decisions of China and India, which are already reportedly having a problem with increased exports of Russian oil to their markets.

6. How will the departure of the intelligentsia and the richest people from the country affect Russia?

In addition to significant economic losses, the Russian market must also cope with a huge outflow of talented and educated people. Although there are no official figures on exactly how many people have left Russia permanently, experts say in their report that estimates range from half a million Russians. Approximately half of them are people with high-quality education, valuable work experience, and many of them were focused on technology and industry.

15,000 people who own financial assets worth more than 1 million US dollars also left Russia during the first quarter. This number should represent 20 percent of the total number of the richest Russians, and according to the study, they took with them capital worth at least 70 billion dollars, which is officially reported by the Russian Central Bank. However, the study points out that the bank's official figures are probably significantly underestimated. Data from Dubai real estate companies, which recorded a 100 to 200 percent increase in Russian buyers over the last 4 months, also speak of the massive departure of rich Russians from the country.

If problems persis, please contact administrator.